The SAMR (State Administration for Market Regulation) and NMPA (National Medical Products Administration) - former CFDA (China Food and Drug Administration) - oversee the management and registration of drugs (pharmaceuticals), pharmaceutical products, medical devices, in-vitro diagnostics and cosmetics.

Cisema works with pharmaceutical companies large and small for China marketing approvals, drug master filing (DMF), China good manufacturing practice (GMP) gap analysis, CMC consulting and other quality and regulatory services.

In China, drugs are divided into:

1. chemical drugs,

2. TCM (Traditional Chinese Medicine), and

3. biological products for classified management.

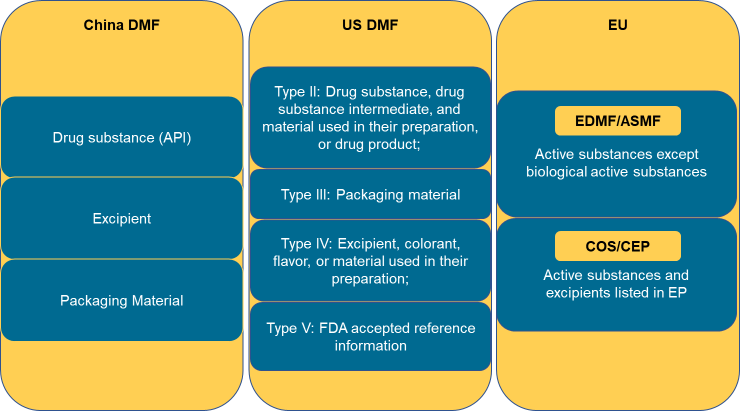

Chemical drugs and biologics are the primary categories for which we support importing manufacturers. The demand for DMF of active pharmaceutical ingredients (API), packaging and excipients is also fast increasing. If you would like to learn in detail about our services relating to these topics or receive ongoing updates and education content, please request our brochure or contact a Cisema expert.

Approval categories and processes for chemical drugs, biologics and DMF are presented in brief below, followed by some sample of recent customer projects.

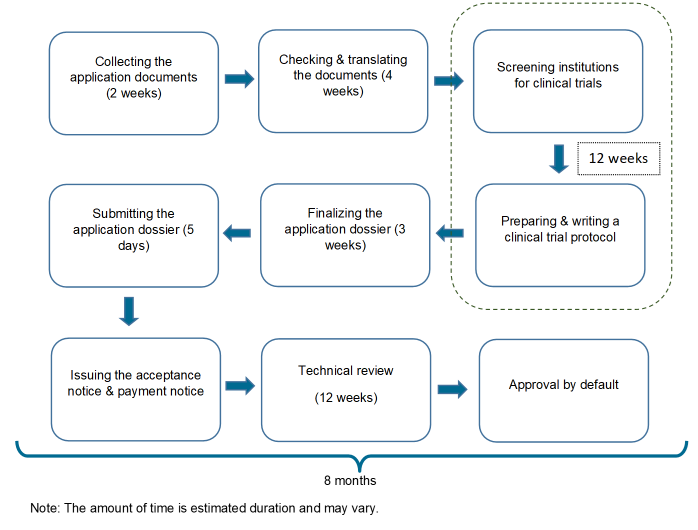

Pre-market Registration: In view of the special characteristics of pharmaceutical products (including API, excipients and packaging), foreign manufacturer shall appoint a professional domestic registration agent for drug registration in compliance with Chinese regulations.

Post Market Surveillance: According to Drug Administration Law of the People's Republic of China (2019 version), China implements system of drug market license holder management, which to manage drug safety, effectiveness and quality of drug development and production, which is called full life cycle management of drug. If the license holder is a foreign manufacturer, the foreign manufacturer shall appoint a domestic legal agent for fulfillment of legal obligations and responsibilities related to the license (product).

Applicants who want to appoint a Chinese distributor as NMPA Legal Agent should be aware of the risks involved. Unfortunately, if your distributor is either lack of general knowledge of regulations and standard policies or not fully transparent to you, you may lose your independence regarding product import, preventing you from changing distributors. Your options when choosing the NMPA Legal Agent is explained in more detail in our brochure.

➤ Are you a pharmaceutical manufacturer and need support with the supplementary dossier and second NMPA evaluation?

➤ Are you a pharmaceutical packaging or ingredients manufacturer and require assistance attaining your DMF?

➤ Would you like to know how much time and costs you should expect for the China NMPA registration?

➤ Wondering how many test samples you need to provide to Chinese laboratories?

➤ Are you unsure who to appoint as your NMPA Legal Agent and want to protect your independence?

➤ Are you unsure if your ingredients are China compliant?

➤ Do you have any concerns about revealing the exact manufacturing method and ingredients of your pharmaceutical product as part of the registration?

➤ Do you worry about miscommunication with NMPA because of culture and language differences?

➤ Are you afraid of failing the Chinese tests?

➤ Wondering which application documents you have to submit?

➤ Advice on applicable legislation and regulations.

➤ Determining whether your products need NMPA approval.

➤ Analysis of ingredients for compliance with Chinese regulations.

➤ Legal representation in China as NMPA Legal Agent for registration and regulatory affairs and protecting your independence.

➤ Application for China NMPA registration.

➤ Provision of complete document checklist and templates, including advice on the correct completion.

➤ Translations and notarizations.

➤ Provision of comprehensive test sample list.

➤ Close follow up of your sample tests in China.

➤ Communication and coordination between you and the Chinese authorities in technical and cultural terms.

➤ Provide response proposal of technical reviews by CDE.

➤ Assist site inspection initiated by CDE & CFDI.

➤ Follow-up support during the NMPA application of pharmaceuticals containing API or Drug.

Deutsch

Deutsch  Italiano

Italiano  Français

Français  日本語

日本語  한국어

한국어