China clinical trials for new drug registrations report for 2021 was released by the Center for Drug Evaluation (CDE) on June 7, 2022.

The report shows that the total annual registration volume of the new drug clinical trials (including innovative drugs and modified new drugs) in 2021 exceeded 3,000 for the first time with a total of 3,358 items. This represents a 29.1% increase compared with the total annual registration in 2020. Among them, the number of new drug clinical trials was 2,033, an increase of 38.0% over 2020.

Highlights

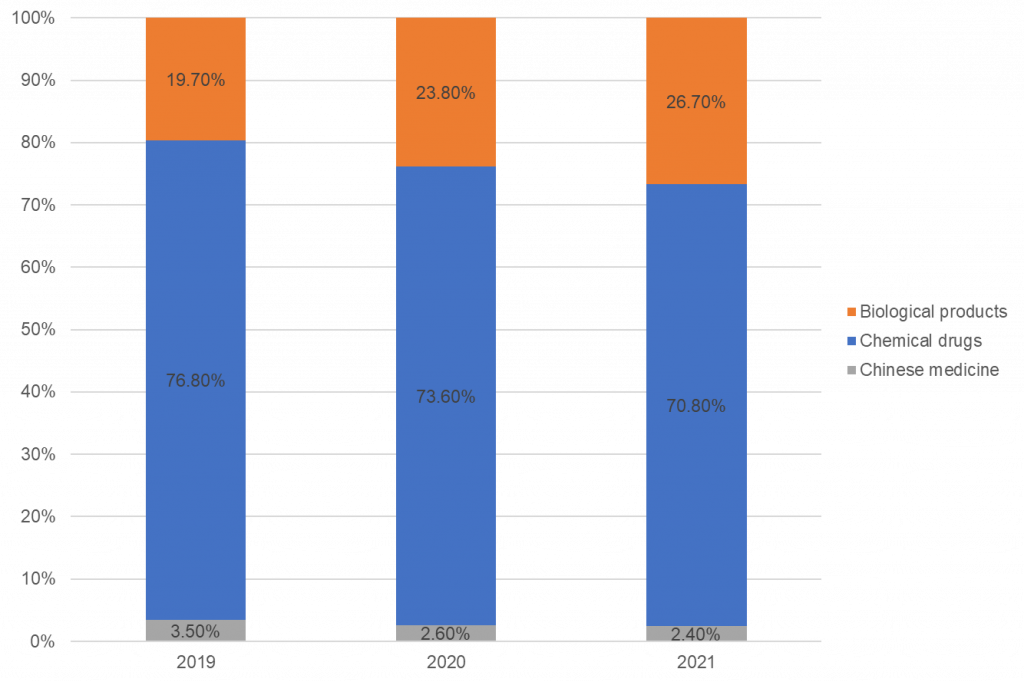

Registrations by drug type: over 70% were chemical drugs

In 2021, China’s drug clinical trials were still dominated by chemical drugs, accounting for 70.8%. This was followed by biological products at 26.7%. The least was Chinese medicine, only 2.4%. Compared with the data of the past three years, the proportion of clinical trials of various drugs is similar, but the proportion of biological products is increasing year on year, and the proportion of chemical drugs and traditional Chinese medicines is decreasing year on year.

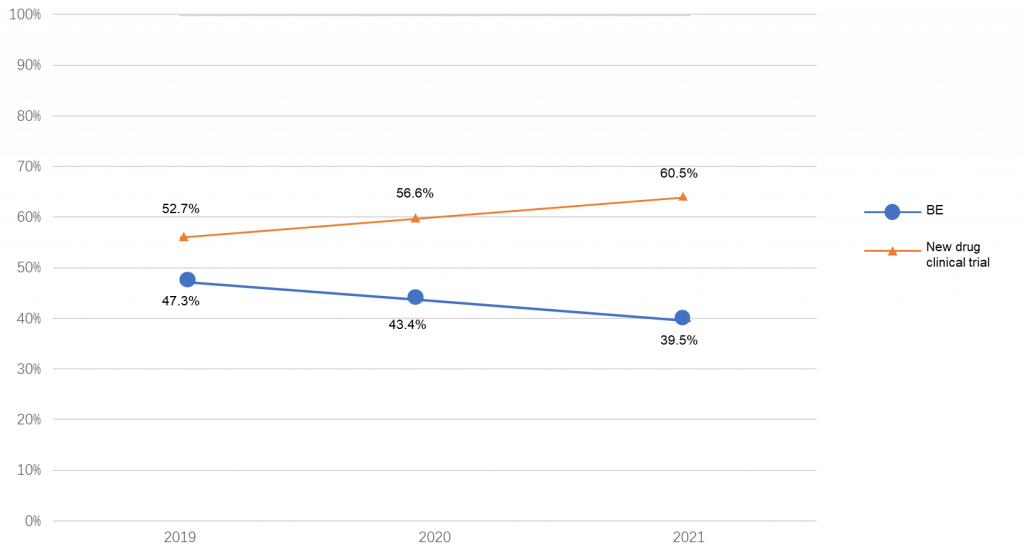

New drug registrations by type of trial: Clinical trials (60.5%) vs bioequivalence trials (39.5%)

There were 2033 new drug clinical trials (60.5%) and 1325 bioequivalence trials (BE trials) (39.5%) registered in 2021. Compared with the data of the past three years, the proportion of clinical trials of new drugs has increased year on year, while the proportion of BE trials has decreased.

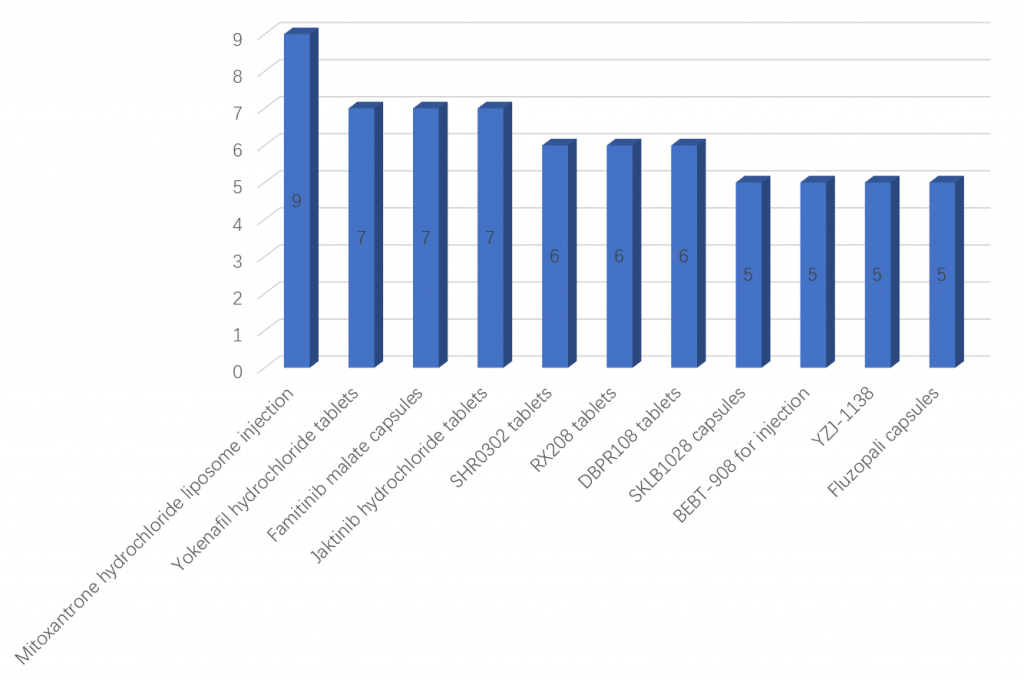

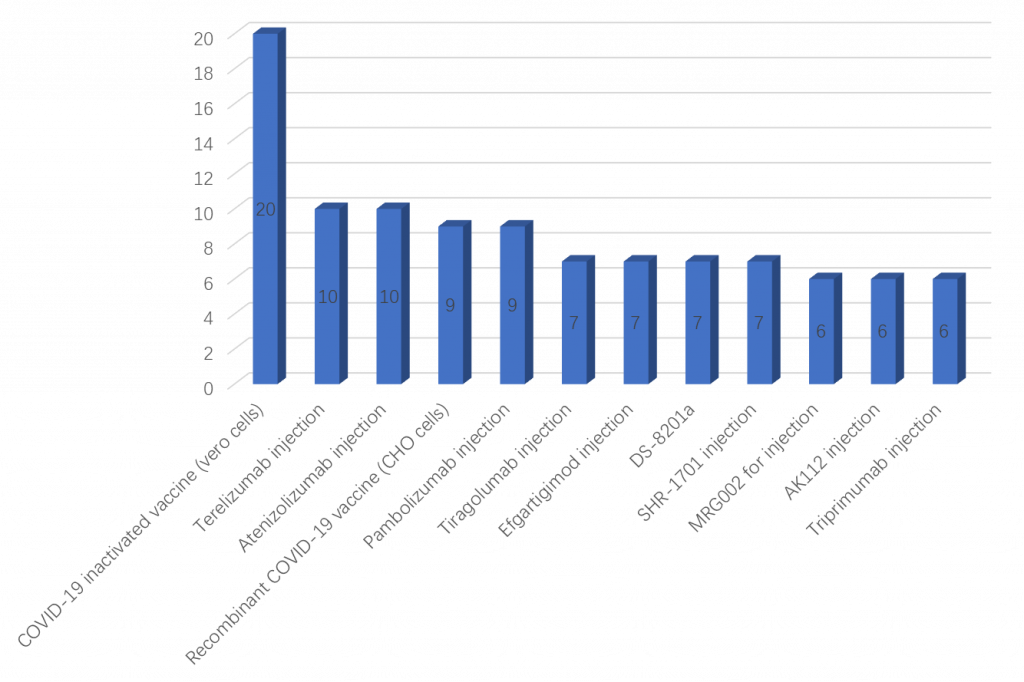

Drugs with most number of China registered clinical trials

Among the 2033 new drug clinical trials registered in 2021, the following table shows a variety of different chemical drugs with the most number of clinical trials registered, adding up to a total of 68 registered clinical trials (see Figure 3).

The following table shows a variety of different biological products with the most number of clinical trials registered, adding up to a total of 104 registered clinical trials (see Figure 4).

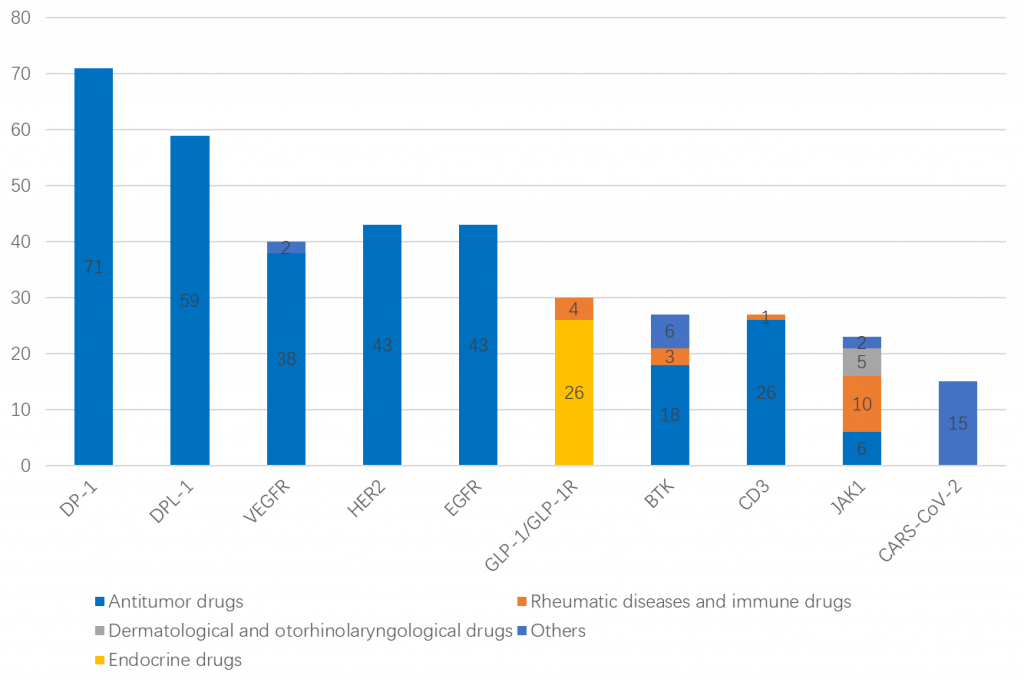

Indications of the top 10 targeted drugs

The top 10 targets of registered clinical trials in 2021 can be seen in the graphic below. They are principally anti-tumor drugs (see Figure 5).

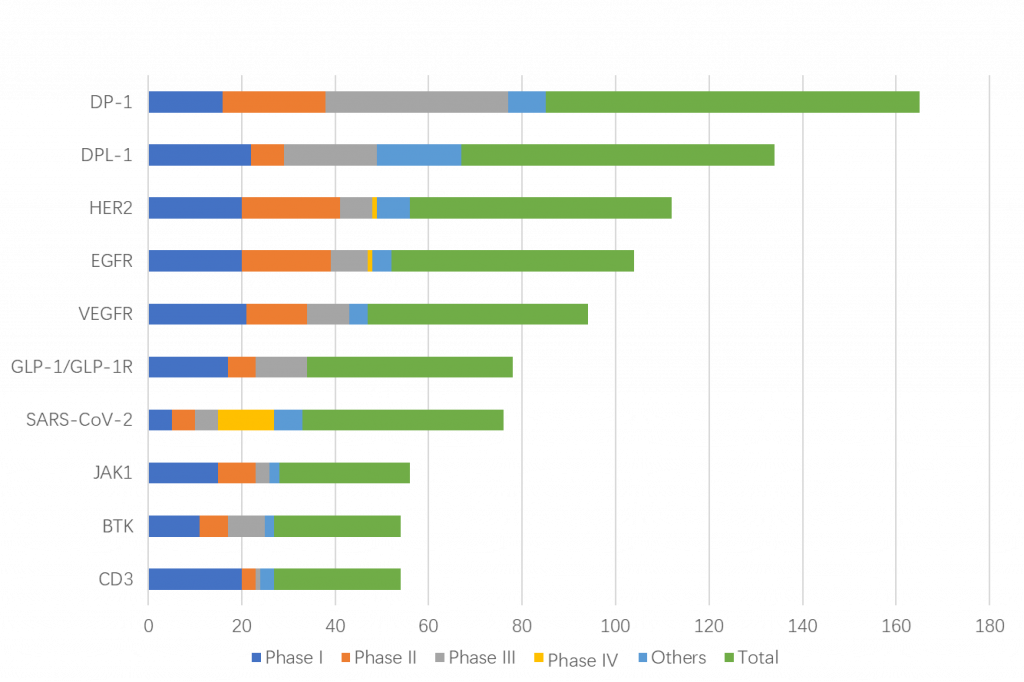

Phase I – IV clinical trials for the top 10 targeted drugs

Among the top 10 targets, phase III clinical trials account for the largest proportion of PD-1 and PD-L1 targets. It is expected that the competition for PD-1 and PD-L1 targeted drugs will be more intense in the future.

Phase II clinical proportion of HER2 and EGFR targets is also relatively large.

Phase I clinical trials accounted for more than 40% of drug clinical trials in VEGFR, GLP-1/GLP-1R, JAK1 and CD3 (see Figure 6).

Summary

Overall, at present, new drug research and development in China mainly revolves around the field of tumors, and most of them are in the early stage, mainly in Phase I clinical trials. The targets of new drugs are relatively concentrated with competition in PD-1/PD-L1 becoming red-hot.

If you are interested in conducting a China clinical trial for a new drug registration, please contact Cisema. We are experienced in establishing clinical trial protocols which conform to NMPA requirements and running local clinical trials in China for pharmaceuticals and medical devices alike.

By Yu. If you would like to learn more about the Annual Report on the Progress of Clinical Trials of New Drug Registration or our registration and CRO services for pharmaceuticals, medical devices, IVDs, cosmetics, health foods, industrial or consumer goods contact Cisema.

Deutsch

Deutsch  Italiano

Italiano  Français

Français  日本語

日本語  한국어

한국어