China drug evaluation report 2022 was released by China’s Center for Drug Evaluation (CDE) in September 2023.

The report helps industry stakeholders understand the various categories of drug reviews, approvals and rejections by the CDE.

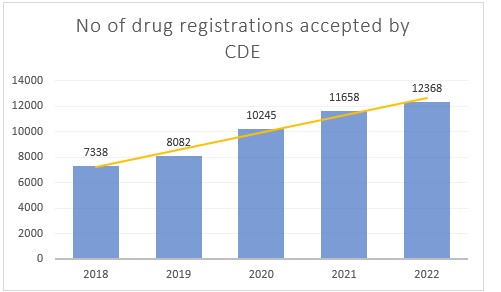

China drug registration applications

In 2022, the CDE accepted over 12,000 drug registration applications for traditional Chinese medicines, chemical drugs, biological products and drug-device combination products. This represents a year-on-year (YoY) growth of 6% showing the continued development of China’s pharmaceutical market.

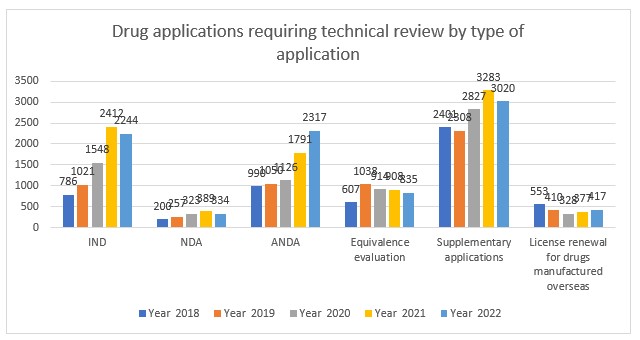

Applications requiring technical review by category

75% of applications that were accepted required a technical review with a slight decrease for biologics and traditional Chinese medicines, whereas chemical drugs continued to see growth as the dominant drug modality in China.

Applications for Investigational New Drugs (IND) decreased for the first time over the last 5 years, along with New Drug Applications (NDA), equivalence evaluations and supplemental applications. Increases were witnessed for Abbreviated New Drug Applications (ANDA) and license renewals for drugs manufactured overseas.

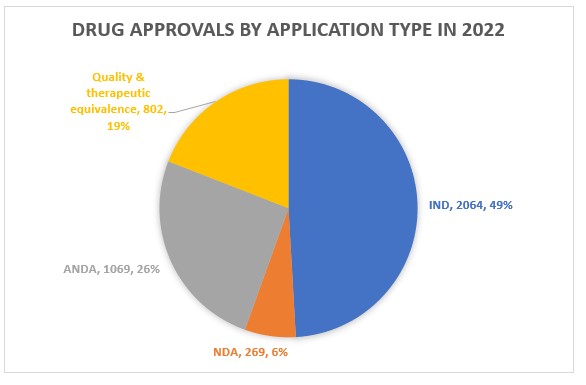

China drug approvals during 2022

The CDE approved or recommended the approval of over 10,000 applications in 2022. Direct approval was granted to nearly a third, with supplemental and IND applications contributing to over half of the approvals.

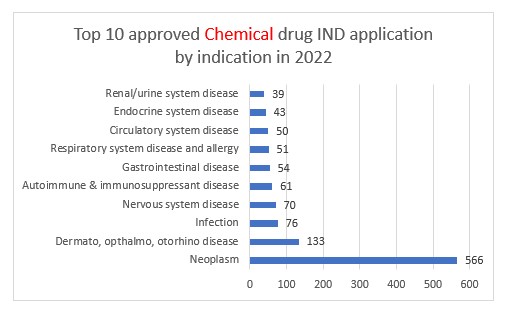

Chemical drug IND applications approved by CDE in 2022

Approved applications for chemical INDs decreased slightly YoY by 3% from 1327 to 1286. Of the approvals that were granted over half were for the fields of neoplasm, dermatology, ophthalmology and otorhinolaryngology.

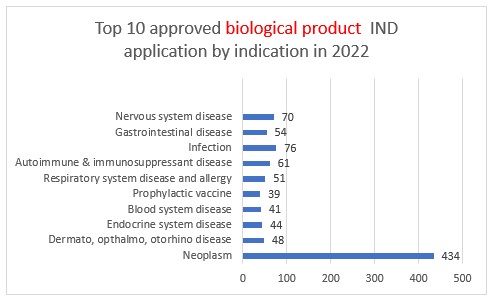

Biologic drug IND applications approved by CDE in 2022

The CDE approved 40 IND applications for preventive biological products, 18 of which were innovative new preventive biological products, which represents a year-on-year decrease of 25%.

In addition, the CDE approved 729 IND applications for therapeutic biological products, 533 of which were for innovative therapeutic biological products, which represents a year-on-year increase of 7.8%.

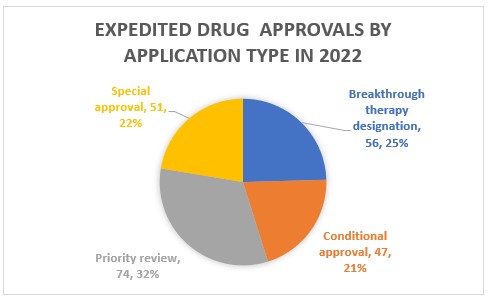

Expedited drug applications

China introduced four accelerated drug approval channels in 2015 to help expedite the launch of urgently needed drugs:

- Breakthrough Therapy Designation (BTD)

- Conditional Approval (CA)

- Priority Review (RA)

- Special Approval

More routes to market were also added with the creation of 2 pioneering zones to reduce the cost of clinical research and accelerate urgently needed medical devices and drugs into the Chinese market:

- Hainan-Boao International Medical Tourism Zone

- Guangdong-Hong Kong-Macao Greater Bay Area.

The report also lists the drugs that obtained approval for various therapeutic areas. It also expands on reasons for disapprovals such as problems with the R&D project setup, effectiveness or quality control. Click here to read the report in full: China drug evaluation report 2023.

If you would like advice on the best regulatory pathway to market for your pharmaceutical, please contact Cisema.

Deutsch

Deutsch  Italiano

Italiano  Français

Français  日本語

日本語  한국어

한국어